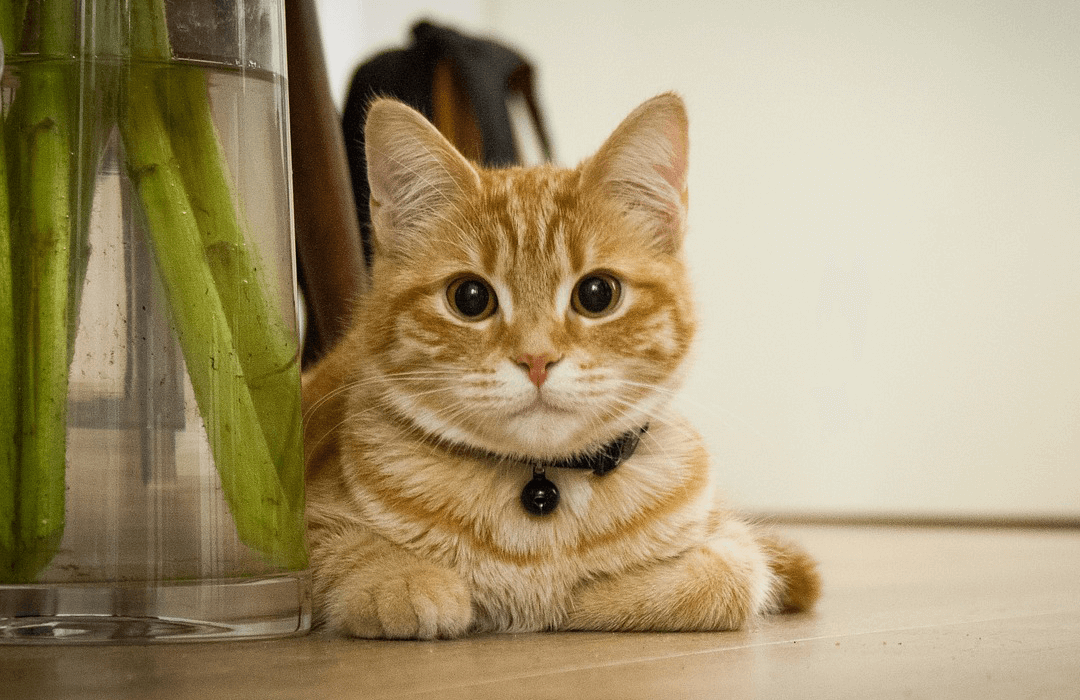

Today many Americans are increasingly treating their cats as members of their family, feeding them gourmet food, paying for daycare and throwing them parties. More than 42 million of U.S. households own a cat, according to the American Pet Products Association, and most ‘cat parents’ enjoy lavishing their loyal companions with products and services to give them a better life. Overall spending in the U.S. pet industry is increasing at about 4% per year, up from $66.75 billion in 2016 to nearly $76 billion a year today.

In fact, when it comes to our feline friend’s cat insurance may be the last thing on our mind, however, like any insurance it can provide owners with solace when it comes to their cat’s health.

We are all aware that our furry friends can get sick and injured from time to time, and these conditions are apt to occur more frequently as ‘Kitty’ ages.

If your cat was to fall ill or have an injury today, the average cost of an unexpected visit to a vet will set you back anywhere between $800.00 and $1,500.00. This can be a heavy burden on most Americans, who according to a recent Economic Well-being of U.S. households report, would not be able to cover an unexpected cost as high as $800.00.

By comparison the average annual premium for cat insurance is $335.00 a paltry $27.00 a month, meaning such insurance could save you thousands in the long run.

Here are three important reasons why you need cat insurance for your pet:

Gives Peace of Mind

Like any other kind of insurance, cat insurance gives owner’s peace of mind by preparing them for any unfortunate event, be it sickness or accident which may befall our cats. With cat insurance you can choose treatments for your ailing or injured pet based on the best medical advice available and not restricted by family finances. Unlike human health policies where you are required to use a specific health care provider, cat insurance policies allow you to obtain care from the veterinarian of your choice. Such insurance policies reimburse up to 80% of costs after deductibles and reimbursement is very straight forward, you just provide the veterinary bill to the pet insurance company.

Easier to Budget Cat Care Costs

By providing your feline companion with insurance you can refrain from using your family’s emergency funds when your cat becomes unwell, saving you thousands of dollars in unexpected bills. On signing up, you decide which payment plan works for you, cat insurance policies can be paid monthly, quarterly or annually. So, you don’t have to pay your fees in one go, you can spread payments out to suit your budget.

However, you should be aware that some policies offer more restrictive cover in terms of what they will pay and how long they will keep paying. It is imperative to understand what you are signing up to and to be sure your chosen policy meets your kitty’s needs now and in the future. Cat insurance covers injuries as well as various illnesses such as digestive issues, cancer and diabetes, it can also cover treatments for cats with allergic symptoms.

Covers your Cat’s Hereditary Condition

A hereditary or genetic condition is an inherited disease caused by a defect in certain genes transmitted to a kitten from their parents. Within their lifetime many cats suffer from serious health problems and congenital conditions, some are inherited or caused by severe inbreeding. Many pet insurance companies may include age limits and restrictions which can mean paying extra fees to cover such a condition.

Given this, it is highly recommended that cat owners avail of cat insurance as soon as their furry companions come into their lives.